Life Insurance in and around Summerville

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Summerville, SC

- Ladson, SC

- Charleston, SC

- North Charleston, SC

- South Carolina

- Goose Creek, SC

- Hanahan, SC

- Ridgeville, SC

- Columbia, SC

- Mount Pleasant, SC

- Myrtle Beach, SC

- Greenville, SC

- Spartanburg, SC

- Sullivans Island, SC

- Simpsonville, SC

- Orangeburg, SC

- Florence, SC

- Walterboro, SC

- Moncks Corner, SC

- Georgetown, SC

- Sumter, SC

- Rock Hill, SC

- Clemson, SC

Your Life Insurance Search Is Over

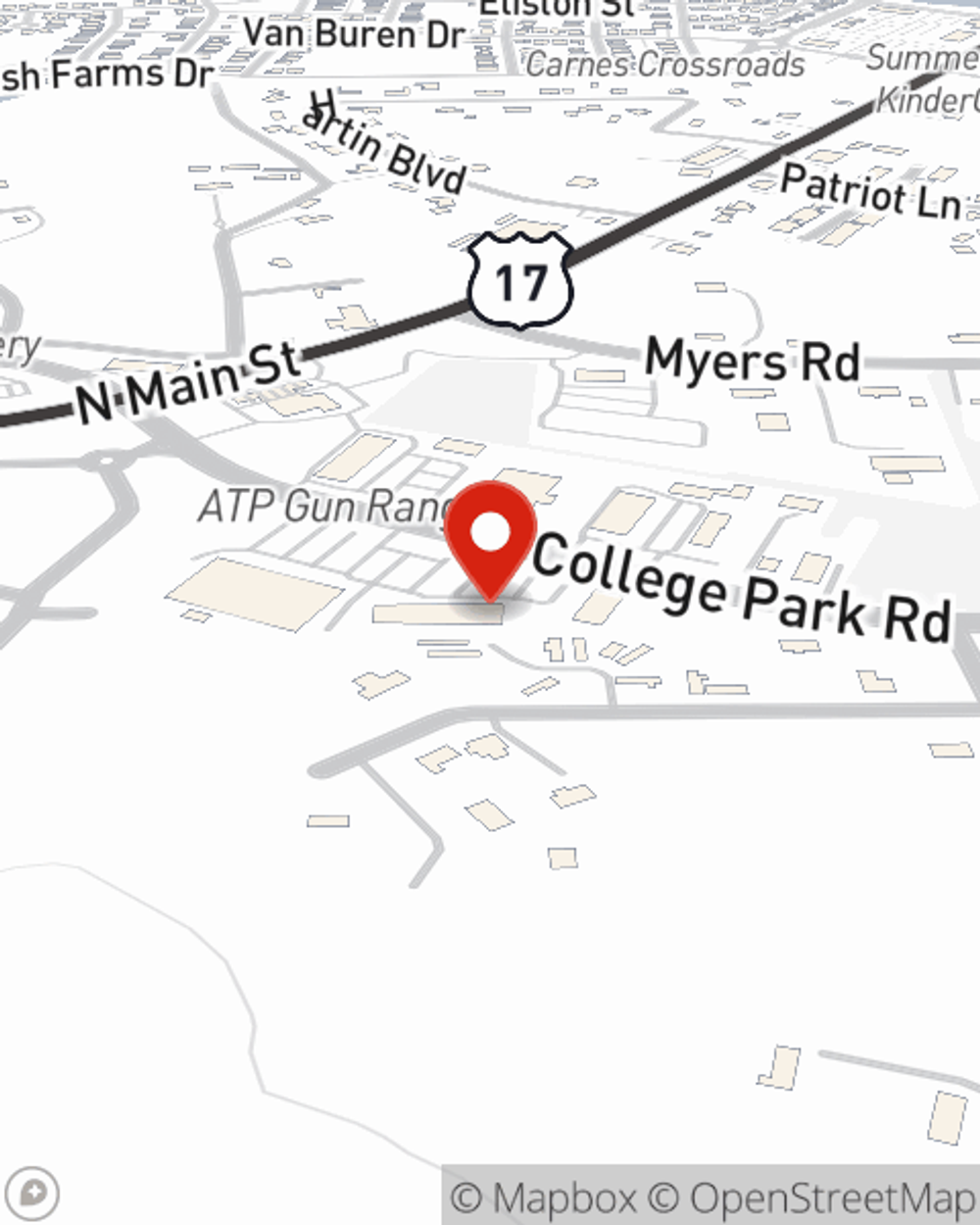

When it comes to high-quality life insurance, you have plenty of choices. Evaluating providers, coverage options, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Larry Matt is a person who is dedicated to helping you generate a plan for your specific situation. You’ll have a hassle-free experience to get budget-friendly coverage for all your life insurance needs.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Wondering If You're Too Young For Life Insurance?

When applying for how much coverage is right for you, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like your current age, your physical health, and perhaps even body weight and occupation. With State Farm agent Larry Matt, you can be sure to get personalized service depending on your individual situation and needs.

To learn more about how State Farm can help cover your loved ones, reach out to Larry Matt's office today!

Have More Questions About Life Insurance?

Call Larry at (843) 486-2071 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.